How To Make Money Through Trading Three Currencies

Over the past few years, an unprecedented corporeality of money has flown into the equity and forex markets from retail traders, and an increasing number of people are now kickoff to day trade.

While this form of trading was originally used by hedge funds and institutional investors, now several platforms are providing offshore trading accounts for retail traders too. In this guide, we review the different offshore trading platforms available for you.

All-time Offshore Trading Platforms 2022 List

While there are several different offshore trading platforms that you can choose from for your trading needs, a listing of the top v such platforms that you should consider has been given beneath.

- eToro – The Overall Best Trading Platform

- Capital.com – The All-time Low Spread Offshore Trading Platform for Forex Traders

- Libertex – The Best Overall Offshore Trading Platform

- Skilling – The Best Offshore Trading Platform for the Lowest Fees

- AvaTrade – The Best Offshore Trading Platform for High Leverage

Number of Trades

100 per year

6 Providers that match your filters

half dozen Providers that match your filters

What nosotros like

Purchase shares and ETFs with 0% commission

Social and copy trading network

Invest and trade crypto with low fees

What we like

Buy stocks and ETFs with zero commission

Extended trading hours for US stocks

Payment methods

What nosotros like

Excellent mobile trading app

Payment methods

Best Offshore Trading Platforms Reviewed

A detailed review of the top 5 trading platforms that you should consider for all your offshore trading needs is beneath. This includes a discussion on the dissimilar asset classes, their fees, and the other factors that you must expect into before deciding on an offshore trading platform or your needs.

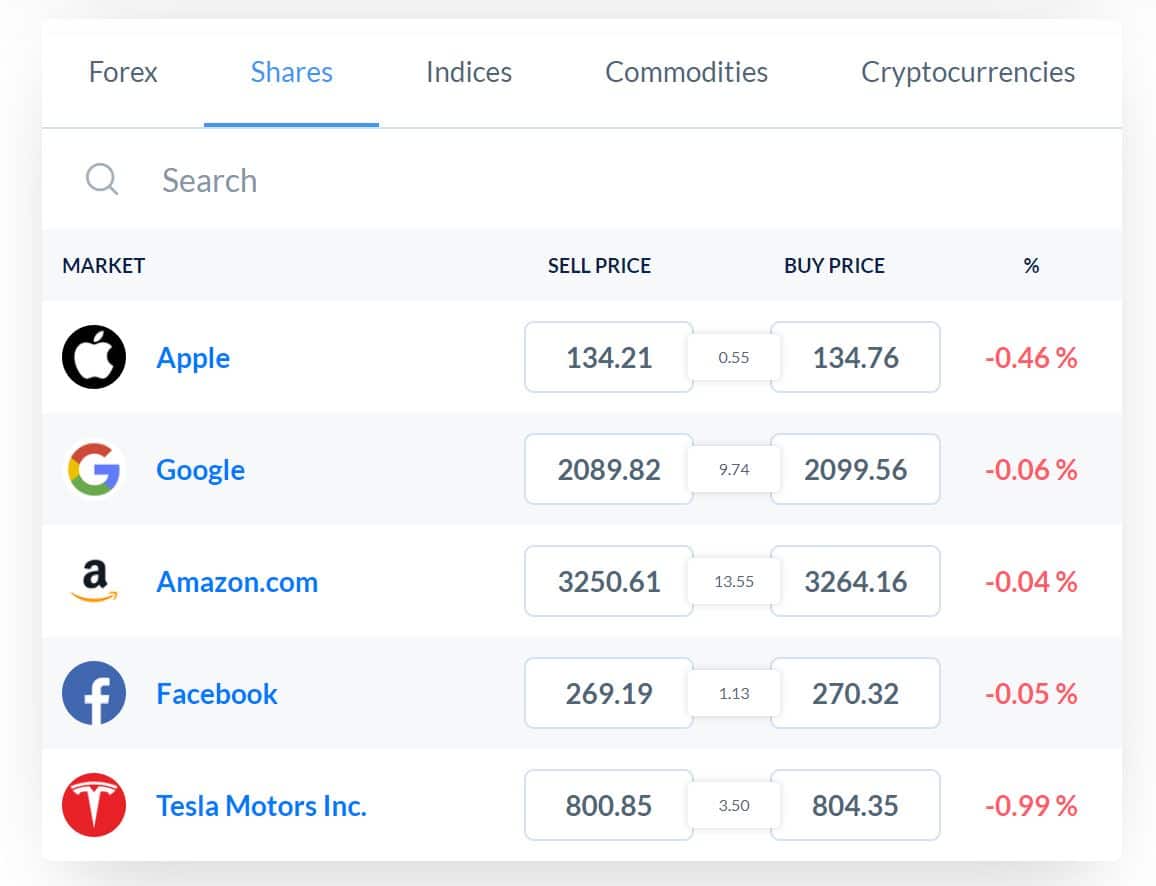

1. eToro – The Overall Best Trading Platform

If you're looking for a user-friendly and convenient platform to begin trading, so eToro is the perfect choice for you. It is the largest and most pop social trading network in the world and allows you to merchandise over 2400 assets, which includes 45+ currency pairs, stocks, indices, cryptocurrencies, and bolt. An additional advantage that eToro has is that it offers CFD trades, which ways that you do not have to pay any fees at all. For fast traders, who open and shut positions very regularly, this no-fee trading option is definitely one of the chief attractions that eToro offers.

If you're looking for a user-friendly and convenient platform to begin trading, so eToro is the perfect choice for you. It is the largest and most pop social trading network in the world and allows you to merchandise over 2400 assets, which includes 45+ currency pairs, stocks, indices, cryptocurrencies, and bolt. An additional advantage that eToro has is that it offers CFD trades, which ways that you do not have to pay any fees at all. For fast traders, who open and shut positions very regularly, this no-fee trading option is definitely one of the chief attractions that eToro offers.

They also allow you to merchandise on leverage on a multifariousness of avails. For example, they offer x30 leverage for near major currency pairs, x20 for minor currencies, and x15 for most major bolt. While trading through eToro, you can use their spider web portal or download their mobile app, allowing y'all to monitor your trading positions on the move. Setting up an account on eToro is a quick and easy procedure, and you not only get access to a social trading network with over 17 million members but also to the different CopyPortfolios. This will let you to copy the trades of more successful and experienced traders, including the virtually successful fast traders.

They also allow you to merchandise on leverage on a multifariousness of avails. For example, they offer x30 leverage for near major currency pairs, x20 for minor currencies, and x15 for most major bolt. While trading through eToro, you can use their spider web portal or download their mobile app, allowing y'all to monitor your trading positions on the move. Setting up an account on eToro is a quick and easy procedure, and you not only get access to a social trading network with over 17 million members but also to the different CopyPortfolios. This will let you to copy the trades of more successful and experienced traders, including the virtually successful fast traders.

eToro is also highly regulated and insured by several agencies worldwide, making it highly trustworthy to trade financial assets. To get started, you lot need to fix an business relationship and add together a minimum eolith of $200, after which you can and so begin trading correct away.

eToro fees

Pros

Pros

- Depression to no fees

- Tight spreads

- Huge range of assets to trade – including stocks, indices, ETFs, cryptocurrencies, currencies, and commodities

- Social trading and re-create trading tools are available

- Regulated past the UK FCA

Cons

Cons

- Does not support signals for forex trades

- Not suitable for traders who utilize advanced charting tools

67% of retail investor accounts lose coin when trading CFDs with this provider. You should consider whether you can afford to accept the high adventure of losing your money.

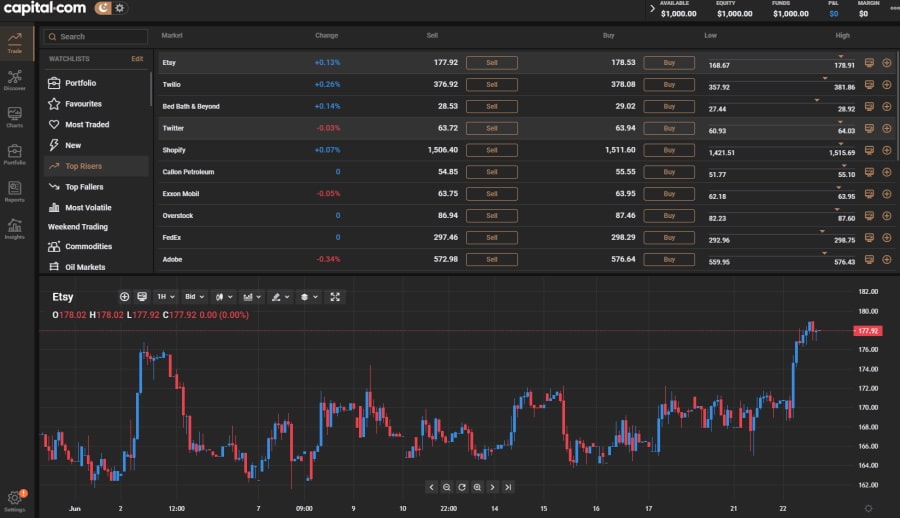

ii. Upper-case letter.com – The Best Low Spread Offshore Trading Platform for Forex Traders

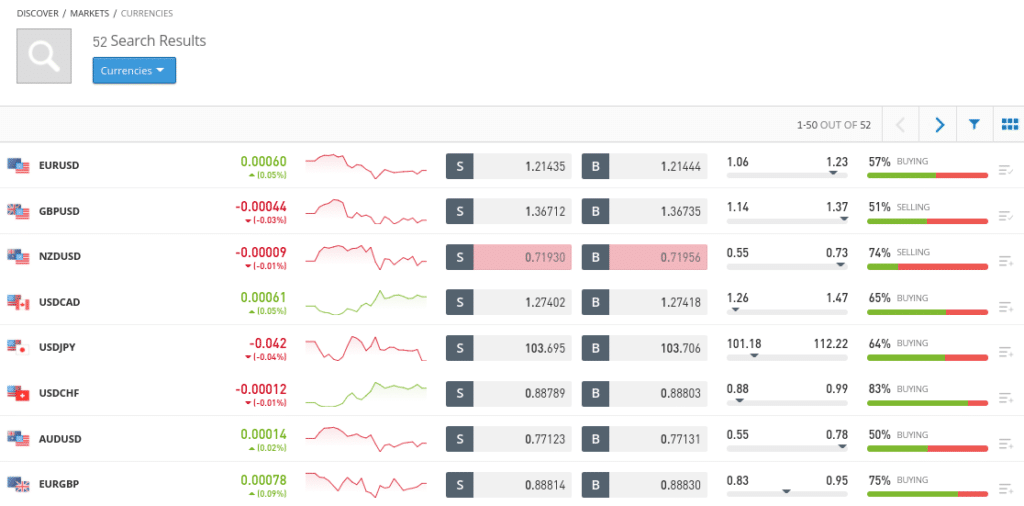

Some other very pop trading platform amidst offshore traders, peculiarly those who trade forex pairs, is Capital.com. It provides 1 of the largest varieties in currency pairs, with over 138 FX pairs available to trade including some of the most exotic ones. The platform also allows you to trade with leverage of upwards to 100x. It offers extremely tight spreads, such as 1.iii pips for GBP/USD and 0.eight pips for the EUR/USD pairs.

Some other very pop trading platform amidst offshore traders, peculiarly those who trade forex pairs, is Capital.com. It provides 1 of the largest varieties in currency pairs, with over 138 FX pairs available to trade including some of the most exotic ones. The platform also allows you to trade with leverage of upwards to 100x. It offers extremely tight spreads, such as 1.iii pips for GBP/USD and 0.eight pips for the EUR/USD pairs.

When trading through majuscule.com, you have two options. Y'all can either use their own trading platform, which offers a wide range of tools and features. The platform too utilises bogus intelligence and car learning capabilities to offer forex trading signals and advice based on your patterns. The other choice is to use the MT4 trading platform in conjunction with capital.com'due south brokerage service. MT4 is more suitable for experienced traders who wish to analyse forex pairs using a variety of charting and statistical tools. MT4 also supports several trading bots and algorithmic strategies.

Capital.com is too highly regulated by a variety of global regulatory agencies, such as the FCA in the U.k.. They have a very low minimum deposit requirement, just 20 EUR/GBP/USD depending on what country you're located in.

Capital letter.com fees

Pros

Pros

- 138 FX currency pairs, including some of the most exotic trading options

- Leverage of up to 100x

- Choice of trading platforms, compatible with MT4

- Low minimum deposit requirements

- Highly insured and regulated

- Uses AI technology for trading recommendations

Cons

Cons

- Does not back up signals

79.17% of retail investor accounts lose money when trading CFDs with this provider.

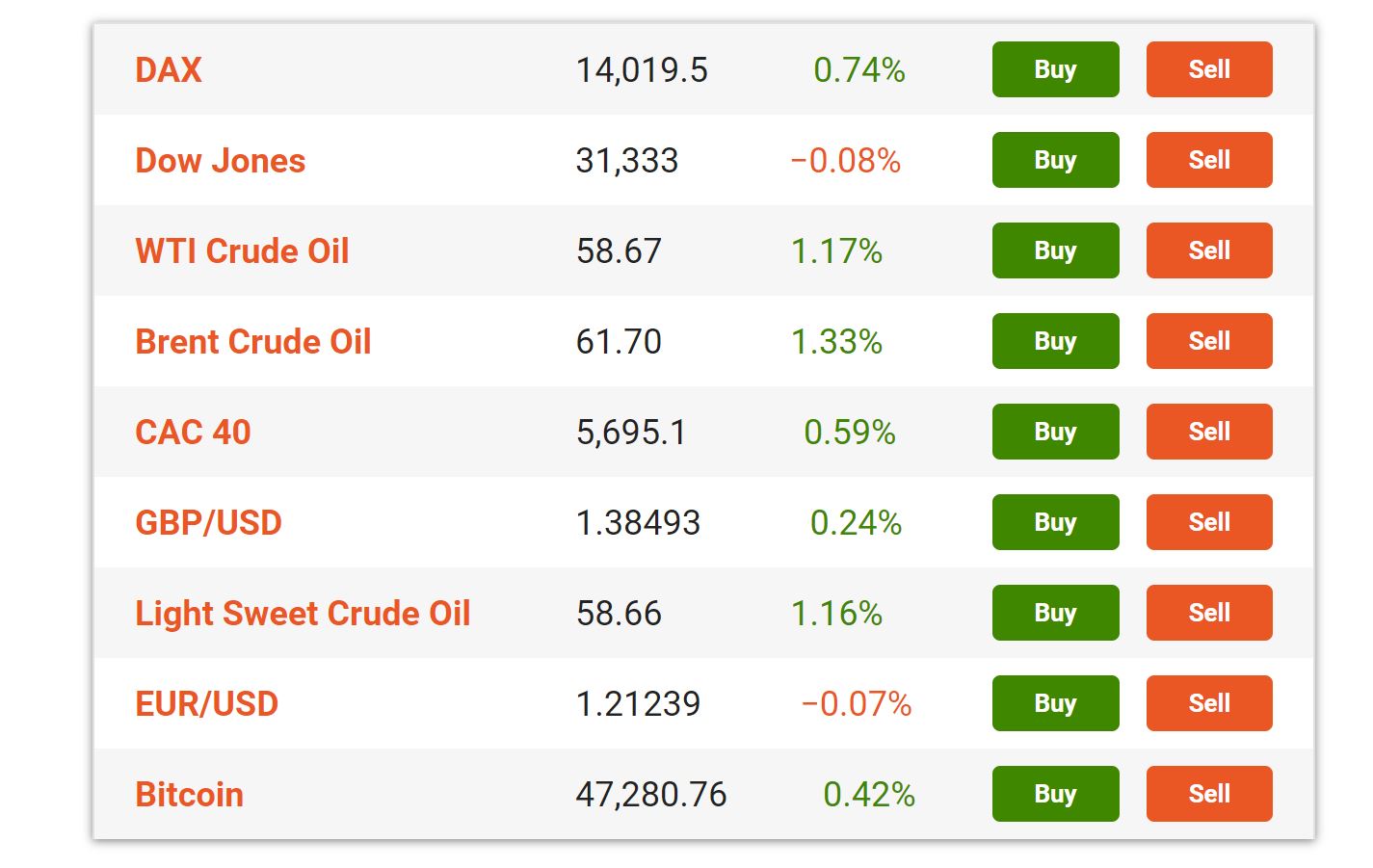

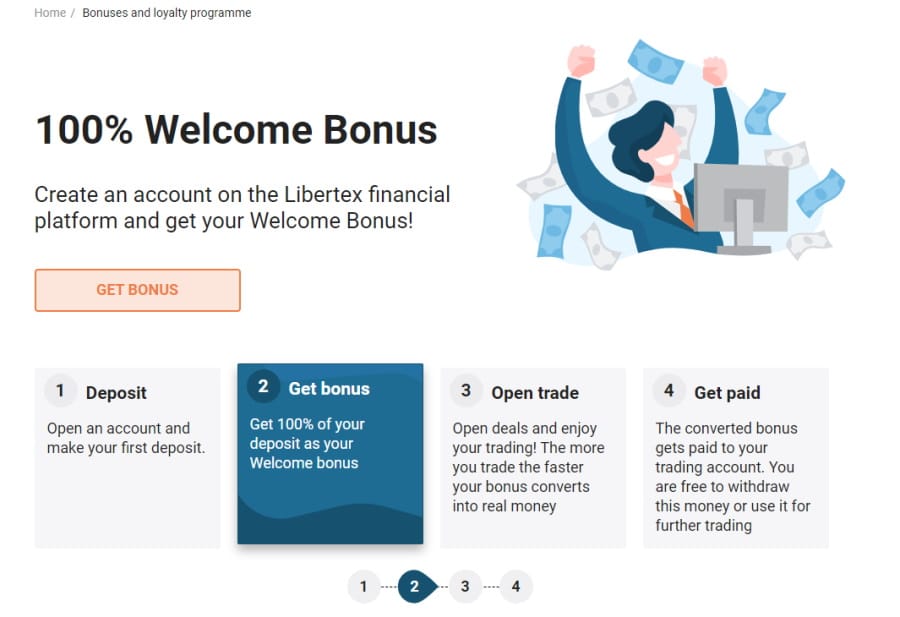

three. Libertex – The Best Overall Offshore Trading Platform

Libertex is easily amid the oldest and most trusted offshore trading platforms that back up a variety of asset classes including stocks, commodities, and currencies. It is best known for being the all-time banker to trade with through the MT4 and MT5 platforms, therefore its forex trading is regarded very highly. Information technology allows you to trade over 51 currency pairs with leverage as high equally 30x.

Libertex is easily amid the oldest and most trusted offshore trading platforms that back up a variety of asset classes including stocks, commodities, and currencies. It is best known for being the all-time banker to trade with through the MT4 and MT5 platforms, therefore its forex trading is regarded very highly. Information technology allows you to trade over 51 currency pairs with leverage as high equally 30x.

Information technology is the platonic offshore trading platform because it offers 0 spreads, which means you can buy and sell the nugget instantly at the same price. On every merchandise you make, yous merely accept to pay a commission of 0.006%, making it the platonic platform for fast traders.

If y'all are a professional trader and meet their requirements for being considered experienced, then Libertex will allow you to trade with leverages as high as 1000x on some currency pairs, easily the highest in the industry. Like with Capital.com, even though Libertex is uniform with MT4 and MT5, you can likewise use their own trading platform which has a broad range of tools including market sentiment assay, a built-in news feed, and different customizable signals services.

Libertex fees

Pros

Pros

- Supports both MT4 and MT5

- High leverage, up to g:i for professional traders

- Very low minimum deposit – equally niggling every bit 10GBP

- Regulated and insured by CySEC

- Very low fees and commissions

Cons

Cons

- Execution times are slower than its competitors

CFDs are complex instruments and come up with a high gamble of losing coin rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you lot empathize how CFDs work and whether you can beget to take the loftier take chances of losing your money.

4. Skilling – The Best Offshore Trading Platform for the Lowest Fees

While Skilling is a relatively new platform, it has quickly become very popular because of the high leverage that information technology offers for all traders. It offers forex and CFD products, with leverage equally high equally 500x for major and 200x for minor currency pairs, which is much higher than most other high leverage forex brokers. In addition to allowing traders to trade forex pairs, it likewise has commodities (with 100x leverage), gold (with 200x leverage). While it besides provides access to stocks and cryptocurrencies, the leverage on these is much lower, at 10x and 5x respectively.

While Skilling is a relatively new platform, it has quickly become very popular because of the high leverage that information technology offers for all traders. It offers forex and CFD products, with leverage equally high equally 500x for major and 200x for minor currency pairs, which is much higher than most other high leverage forex brokers. In addition to allowing traders to trade forex pairs, it likewise has commodities (with 100x leverage), gold (with 200x leverage). While it besides provides access to stocks and cryptocurrencies, the leverage on these is much lower, at 10x and 5x respectively.

The platform is regulated by the CySEC, and information technology does non charge any fees or commissions on trades. They have very tight spreads, and too offers re-create trading for those who are looking to capitalise on the experience of more good fast traders.

Skilling fees

| Fee | Amount |

| Stock trading fee | o% Commission on Skilling'southward Trader Business relationship |

| Forex trading fee | Variable spreads starting from 0.vii% |

| Crypto trading fee | Spread. 0.20% for Bitcoin. |

| Inactivity fee | €10 per calendar month afterwards one twelvemonth |

| Withdrawal fee | Free |

Pros

Pros

- 800+ financial instruments on the platform

- Regulated past the CySEC

- No trading fees or commissions

- Offers copy trading services

Cons

Cons

- No ETF trading allowed

Your uppercase is at gamble when trading CFDs with this provider.

5. AvaTrade – The Best Offshore Trading Platform for Loftier Leverage

If you're an experienced trader who is looking for advanced trading tools, high leverage trading, and admission to a diversity of fiscal assets, and then Avatrade is the right choice for you. Not only does Avatrade back up MT4 and MT5 trading platforms, merely it is also among the best forex offshore trading brokers. It supports a variety of automatic trading tools such as DupliTrade, AvaSocial, and ZuluTrade.

If you're an experienced trader who is looking for advanced trading tools, high leverage trading, and admission to a diversity of fiscal assets, and then Avatrade is the right choice for you. Not only does Avatrade back up MT4 and MT5 trading platforms, merely it is also among the best forex offshore trading brokers. It supports a variety of automatic trading tools such as DupliTrade, AvaSocial, and ZuluTrade.

Nevertheless, perhaps the biggest USP of Avatrade is that it offers extremely high leverages for nearly trades. For example, on most currency pairs, it offers a leverage of 400x, making it extremely popular for experienced traders who are comfy with the run a risk. At the same time, Avatrade also has very tight spreads (0.ix pips for the EUR/USD pair and 1.6 pips for the GBP/USD pair) which are fixed throughout the day. It offers the opportunity to trade CFDs, thus allowing to trade on vanilla options with low fees on high leverage.

Nevertheless, perhaps the biggest USP of Avatrade is that it offers extremely high leverages for nearly trades. For example, on most currency pairs, it offers a leverage of 400x, making it extremely popular for experienced traders who are comfy with the run a risk. At the same time, Avatrade also has very tight spreads (0.ix pips for the EUR/USD pair and 1.6 pips for the GBP/USD pair) which are fixed throughout the day. It offers the opportunity to trade CFDs, thus allowing to trade on vanilla options with low fees on high leverage.

AvaTrade fees

Pros

Pros

- Regulated in 6 different jurisdictions and in compliance with U.k. regulatory requirements

- Supports FX vanilla options and has a professional desktop platform

- Uniform with both MT4 and MT5 for advanced analysis

- Tight spreads combined with low fees

- Leverage of up to 400x

- Very depression minimum deposits – as little every bit 100 USD/GBP

Cons

Cons

- Has a comparatively limited selection of financial avails to merchandise on

71% of retail CFD accounts lose money with this provider.

Offshore Trading Platforms – Fee Comparison

A tabular comparison of the different fees charged for forex pairs by height offshore trading platforms has been discussed below.

| Proper name of Broker | Trading tool | GBP/USD Spread | EUR/USD Spread |

| eToro | Social trading platform – CopyTrade | 2 pips | 1 pip |

| Capital letter.com | Huge range of 138+ FX currency pairs | i.3 pips | 0.vi pips |

| Libertex | Highest leverage for professional traders – up to 1000x | 0 (fee of 0.006%) | 0.9 pips |

| Skilling | Loftier leverage trading with several pairs available | ane.3 pips | 0.9 pips |

| Avatrade | High leverage of upward to 400x alongside vanilla options | 1.six pips | 0.9 pips |

Offshore Trading Apps Assets & Software Comparison

| Asset Class/Software | eToro | Capital.com | Libertex | Skilling | AvaTrade |

| Forex | Aye | Yes | Yes | Aye | Aye |

| Stocks | Aye | Yes | Yes | No | No |

| Commodities | Yes | Yes | Aye | Yep | Yes |

| Cryptocurrencies | Yes | Yes | No | No | No |

| Indices | Yeah | Yes | No | No | No |

| MT4 Trading Platform | No | Yes | Yes | No | Aye |

| MT5 Trading Platform | No | No | Yes | No | Yes |

Best Offshore Trading App

Your pick of the best platform that suits your trading needs and requirements will differ largely on the footing of your trading needs and level of experience. Even so, the overall all-time offshore trading platform is Libertex. Not only does it offering a wide range of avails that you tin can trade through, including stocks, commodities, and currencies, it is likewise incorporated and regulated in Cyprus, making it a trustworthy offshore trading brokerage provider for day traders. They provide low spreads, high leverage, and are uniform with both the MT4 and MT5 trading platforms. In addition to this, they besides take very low minimum deposits and are generally known for their zero spread trading.

How to Cull the Best Offshore Trading Platform for Y'all

There are several things that y'all should keep in heed while trying to select the correct offshore trading platform for your needs. Your selection of broker has a direct and proportionate effect on how successful your trading strategy will be, and therefore it is important for you to look at a diversity of factors earlier deciding on a particular broker. A listing of the various factors that deserve some consideration has been discussed beneath.

Regulation and Prophylactic

Even for a normal trading account, your choice of broker is a central cistron. This becomes even more important for an offshore account since the safety and security of your money is of the utmost importance. Information technology is important for you to select a broker that is regulated for a variety of reasons. The first and primary reason is that regulated brokers are inspected and monitored to ensure that they exercise non manipulate or exploit customers. This is particularly of import when it comes to market place-making brokers since they have a disharmonize of interest between their trading sectionalisation and brokerage division.

Therefore, if you lot are trading with an unregulated banker that makes markets, they might have a tendency to skew prices in the wrong direction in instance they are facing pregnant losses. This will adversely bear on you as a trader on the other side of the trade, and reduce your profitability. Still, this gamble does not present if you are dealing with a regulated broker, since they cannot manipulate prices based on their whims and fancies.

Another reward of using a regulated broker is that they are safer and keep your capital secure. In that location have been numerous instances of brokers absconding with the majuscule that was invested with them and the like, resulting in huge losses to the investors. This is non a possibility with regulated brokers, since they are required to have insurance for the funds that they concur on their platform. This ensures that the funds you eolith with them are rubber and can be withdrawn at any given point in time.

In order to make sure that the broker you lot are investing through is prophylactic and regulated, you should only consider brokers that are regulated by Tier-ane agencies. In that location are several such agencies that belong to dissimilar countries in the world, and they each employ to a different jurisdiction and/or asset grade. For example, if you lot are trading in the United kingdom of great britain and northern ireland, so the FCA is the number 1 regulatory agency that you lot should exist on the lookout for. Commodity trading in the United states of america is regulated by the CFTC, whereas brokers that operate in Cyprus are regulated past the CySEC.

Assets

The next factor to consider earlier trading through an offshore trading platform is the variety of assets that information technology offers. Fifty-fifty if you are only going to be trading one or two nugget classes, it is always advisable for you to trade on an offshore trading brokerage platform that provides diversity in terms of asset classes. This will be useful later if you cull to aggrandize your trading horizons and begin offshore 24-hour interval trading other assets too.

In addition to this, platforms that offer access to more than 1 asset course also commonly have more features than other platforms since they have to cater to a variety of traders. Usually, multi-asset offshore trading platforms allow yous to merchandise stocks, currencies, bolt, indices, ETFs, and cryptocurrencies.

Fees

The fees y'all pay are also an important consideration that will affect your bottom line. They likewise impact the kind of strategies that you tin can employ on a detail platform. For example, an offshore trading platform that charges loftier commissions on each trade that you lot make implies that you lot volition non be able to scalp trade through it, because your pocket-sized profit margins volition be wiped out past the commissions, resulting in negligible profits or even losses.

The fees charged by a platform can be divided into two types: trading fees and non-trading fees. Trading fees refer to the fees that a trader incurs whenever they make a trade, this could exist in the form of a commission or a spread. On the other hand, not-trading fees are fees that are not direct related to the trading action on the account. For instance, this could include inactivity fees, deposit and withdrawal fees, too as account direction charges.

Before you begin trading through an offshore platform, it is important for you lot to be enlightened of the different fees that the platform charges. Usually, these fees differ across asset classes and are dissimilar for each country and jurisdiction, so you should look at the ones applicative to your trading needs. For the same functionality, you should always prefer a platform that charges lower fees over one that has loftier fees.

73.81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether yous can beget to take the high chance of losing your money.

Trading Committee

A commission is a flat fee that yous pay for each trade gild that y'all place. Ane of the advantages of commissions is that they are known in advance, therefore y'all can hands arrange commissions and business relationship for them when backtesting a strategy or preparing a programme for trading. Commissions are usually volume-based, and the greater your trading volume, the lower the commissions that yous will accept to pay. At the same time, commissions can sometimes be higher than spreads.

Unlike brokers offer spreads and commissions, and some brokers even offer a combination of both. While both spreads and commissions have their own advantages and disadvantages, commissions are usually preferred by traders considering they are stock-still, answerable, and quite low if a certain trading volume is exceeded. When selecting a broker that charges commissions, you should ever bank check if this broker offers rebates or discounts. Since offshore trading strategies usually involve large volumes, information technology will exist piece of cake for you to come across the threshold and be eligible for rebates, if any.

Spreads

Spreads are the other blazon of trading fee that a platform can charge and unremarkably refer to the difference between the purchase and sell prices of an nugget. Spreads charged by platforms can either be fixed or variable. Fixed spreads stay constant throughout the trading day, whereas variable spreads vary during the trading day based on volatility and liquidity in the marketplace. It is important for you to know what the spread for your broker is, and whether it is fixed or variable. Different brokers have largely unlike spreads depending on the instruments you wish to trade, and spreads can vary fifty-fifty among one particular asset class.

Other Trading Platform Fees

Other platform fees are non-trading fees, and they tin be divided into three types of fees. The first is the management fee for the business relationship, which is an annual charge that you pay for using the platform. The next is the fees for depositing and withdrawing fees to your business relationship. This could be either a coating fee for deposits and withdrawals, a fee for either deposit or withdrawals, or a fee that is merely applicative on detail forms of depositing and withdrawing funds.

The third blazon of fee is the inactivity fee, which just comes into play when y'all practice non apply your account, makes trades, or add funds to your account for more than a particular period of fourth dimension. If this happens, yous will be charged a regular inactivity fee.

Before selecting a banker, it is of import for you to know the different not-trading fees since they as well impact your profitability.

Trading Tools & Features

Aside from the characteristics and criteria mentioned above, there are several other factors that yous have to keep in listen while selecting an offshore broker. These are the features and tools that the platform offers. A larger variety of tools is e'er improve than a smaller one if yous exercise non end upward using all of them. The major features that you should look for in an ideal offshore trading platform have been discussed below.

Fractional Buying and Low Minimums

The primary feature that you need to await at is the possibility of fractional ownership. This allows you lot to purchase a fraction of a share, such as 0.01 of a share or even less. This is particularly useful if yous do not wish to invest a large amount of capital letter into your trading business relationship. For instance, some shares tin can price every bit much as 2000 GBP, and the only style in which yous can buy them with a small uppercase investment is through the use of fractional ownership options. There are several platforms these days that offering this functionality, and this is definitely something you should exist on the lookout man for.

A corollary of having fractional buying of shares on a platform is having low minimum eolith requirements since this allows you to set up an business relationship with low capital investments. Therefore, yous should also look at platforms that have low capital requirements, such equally XTB (minimum eolith of ane GBP) or Capital.com (minimum eolith of 20 GBP).

Automated Trading

The next factor to go along in listen while trading is to look at the automatic trading facilities that they offer. While some brokers allow you to set up up and execute automatic trading strategies through their own platform, the most common way to do this is through the MT4 and MT5 trading platforms. In that location are several types of automated trading strategies that yous could employ. For example, you could choose to trade through bots, trading signals, or copy trade with another trader. Either fashion, it is important for you to find and use a banker that supports automatic trading strategies.

Orders

There are several types of orders that platforms allow you to place. These include market orders, limit orders, finish-limit orders, and end-loss orders. In addition to this, there are numerous timeframes that you lot could set on your orders, such as:

- Good-till-canceled (GTC)

- Solar day Order

- I week

- One month

- Terminate of week

- Cease of month

- Terminate of Year

- Skillful-till-date (GTD)

- Immediate or cancel (IOC )

It is of import for the offshore broker you choose to permit you to place such orders then that you lot tin can merchandise with maximum efficiency.

Research and Analysis

Enquiry and analysis tools are highly important, peculiarly for offshore trading platforms. In that location are two types of inquiry and analysis tools that a platform might offer: technical and fundamental. Technical tools include charting and analysis methods and can be either general or asset-specific. Fundamental tools include economic calendars, fiscal reports, annotator forecasts, and other similar forms of information.

Traders usually perform only one of the two forms of assay, however, it is important to be aware of both since they have an impact on prices and can therefore touch the overall profitability of your strategies. Having a banker that incorporates both fundamental and technical analysis can mean that this job is fabricated easier.

Demo Account

Some platforms require getting used to considering they are designed and structured in a unique way. A demo account helps with this since it enables you to understand how the navigation and lodge execution on the platform works. At the aforementioned time, having a demo business relationship on a platform means that you tin can easily test out your strategies in real market conditions, and build upwards your knowledge and feel without risking real capital. This is a very useful tool, and it is always better to employ a broker that allows you to open up a demo business relationship with them.

Mobile App

A mobile app is very useful since it allows you to monitor your positions and trade on the move, even when you are not near a laptop or a figurer. At the same fourth dimension, most mobile apps too take functionalities that enable y'all to set price alerts and push notifications for a diversity of situations, enabling yous to stay informed on the move.

Payment Methods

The diverseness of methods that yous can utilise in order to withdraw and eolith funds to your trading account is also a cardinal factor to consider. While most brokers allow you lot to deposit funds through bank transfer and credit/debit cards, it is ameliorate to use brokers that allow other forms of eolith also, including electronic wallets such as PayPal, Skrill, and others. This will enable you to hands add and withdraw funds from your business relationship.

Customer Service

The last factor that you must consider is the customer service offering provided by the platform. Those platforms that provide live chat options are e'er highly preferred since this means that your queries tin can exist resolved quickly and easily every bit and when they arise. At the same fourth dimension, you should also await for platforms whose customer service teams are available 24/5 and then that you tin can call or e-mail them during this time and receive answers to your questions.

How to Get Started with an Offshore Trading Platform – Libertex

The procedure of getting started with an offshore trading platform such as Libertex is quite uncomplicated and straightforward and involves 5 steps that have been discussed below in detail.

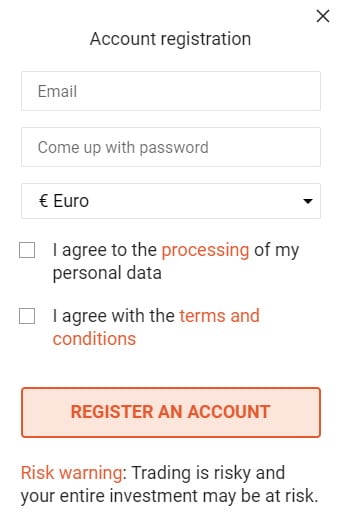

1. Open up a Trading Account

73.81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you lot can beget to have the loftier adventure of losing your money.

The outset footstep is to open a Libertex business relationship. This can be done by simply heading over to their website and clicking on the "Bring together Now" push button. You volition be asked to fill up a form with your contact details, email ID, and your total name. You will also have to set up your login credentials. Alternatively, y'all can apply your Facebook account to log in to Libertex.

2. Confirm Identity

In one case you accept created an business relationship, the next step is to then verify your identity. Since Libertex is a highly regulated broker, they require you lot to submit proof of ID and address proof before your account is verified. For ID proof, y'all can submit any government-issued ID such as a driving license or your passport. For address proof, you could either submit a utility bill or your bank argument.

Once yous have uploaded the requisite documents, the Libertex verification process is pretty quick. As soon equally your account has been verified, you will be able to move on to the next step.

3. Deposit Funds

The next step is to eolith funds into your account. Libertex supports a wide range of payment methods including credit cards, debit cards, PayPal, SEPA/International banking company wire transfers, Skrill, Neteller, and more than. At that place are no deposit fees and your funds are credited to your business relationship instantly except for wire transfers that take between iii-5 days.

4. Search for a Trading Market

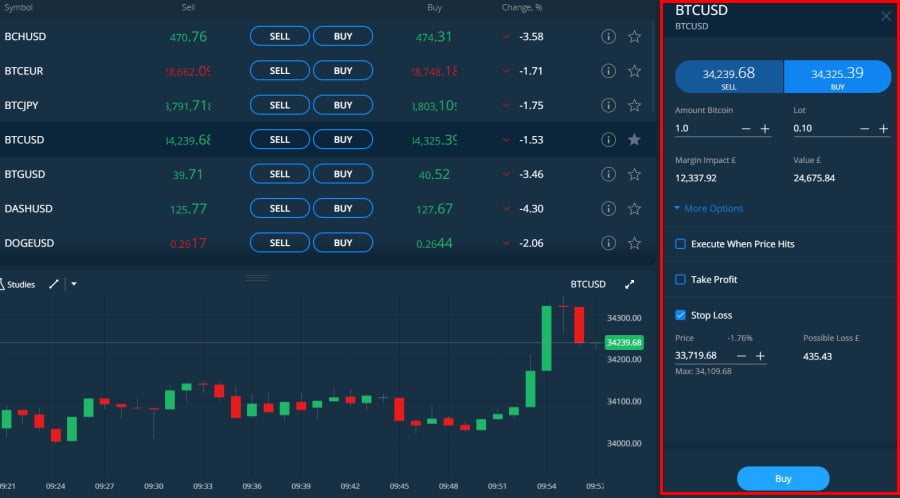

The adjacent stride is to search for the marketplace that you wish to merchandise on. This is as simple every bit going to the search bar and typing the proper noun of the market. You tin then select the market you are interested in. alternatively, you can use the menu to select an asset class and find the market y'all wish to trade in through that.

5. Place a CFD Trade

The last pace is to identify a trade. To do this, simply open up an asset's page, click on buy or sell, enter the amount yous wish to trade, enter the leverage, set the stop loss, and then click on execute. The trade will be executed near instantaneously.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74,5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether y'all empathize how CFDs piece of work and whether you can afford to take the high risk of losing your money

Determination

Offshore trading has very recently become popular amid retail traders every bit a way of evading taxes and gaining access to a wider multifariousness of markets. There are several important considerations to keep in mind when trading through an offshore trader, which have all been discussed. These include full general considerations virtually the platform, such equally the trading fees and the asset course list. Just they besides include the trading tools that the platform provides, such as their assay capabilities and the different guild types that tin can exist placed through the platform.

eToro – Alternative to Offshore Trading Platforms

An alternative to offshore trading is to trade via eToro. It is 1 of the largest social trading platforms in the world, and it provides traders with access to over 2400 markets and instruments. In add-on to this, the platform besides allows you to trade cryptocurrencies, stocks, indices, ETFs, and commodities at no commissions and very competitive spreads. eToro is regulated by agencies all over the globe, and information technology has over 15 one thousand thousand users on its platform

There are two primary reasons why eToro is considered to be one of the best platforms in the world for stock trading. The starting time reason is their platform, which has been designed similar a social media platform o make it piece of cake for beginner traders to navigate it. They also offering a demo account and tutorials for yous to exist able to familiarise yourself with the platform before you lot brainstorm trading. The second reason is their social trading tools. In addition to being able to encounter what other traders think near a particular stock, eToro besides gives you the pick to re-create other more experienced traders and profit from their expertise.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether yous can afford to accept the loftier risk of losing your money.

FAQs

What is the best offshore trading platform?

While different trading requirements necessitate the use of different offshore trading platforms for twenty-four hours trading, the overall all-time platform is Libertex.

Which is the cheapest offshore trading platform?

The cheapest offshore trading platform with a wide diversity of assets and nothing spreads is Libertex, which only charges a very negligible commission on every trade.

Which offshore trading platform offers United states shares?

Virtually offshore trading platforms offer US shares, including Majuscule.com and Libertex.

Are the offshore trading platforms legit?

Aye, offshore trading platforms are legit. While some of them may not be very safe, using an offshore trading platform that is regulated in another jurisdiction helps you lot ensure that your capital will be rubber.

What is the all-time offshore trading platform to purchase Bitcoin?

The best offshore trading platform to trade Bitcoin and other cryptocurrencies is Capital letter.com.

Source: https://tradingplatforms.com/offshore/

Posted by: judemisaid.blogspot.com

0 Response to "How To Make Money Through Trading Three Currencies"

Post a Comment